estate tax change proposals 2021

Effective July 1 2012 as a result of the enactment of SB 3802 as PA. The BBBA did not include a provision to tax capital gains at death or to impose a carryover basis in which the heir.

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

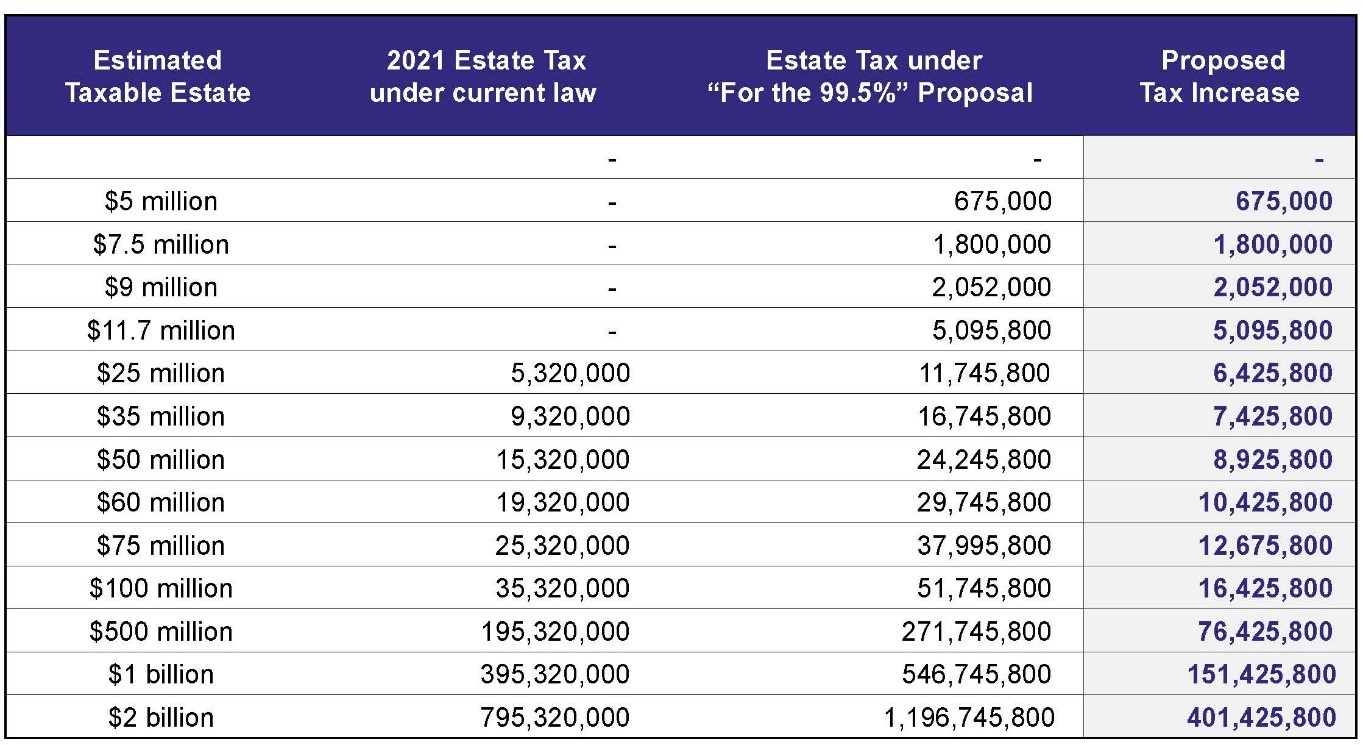

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

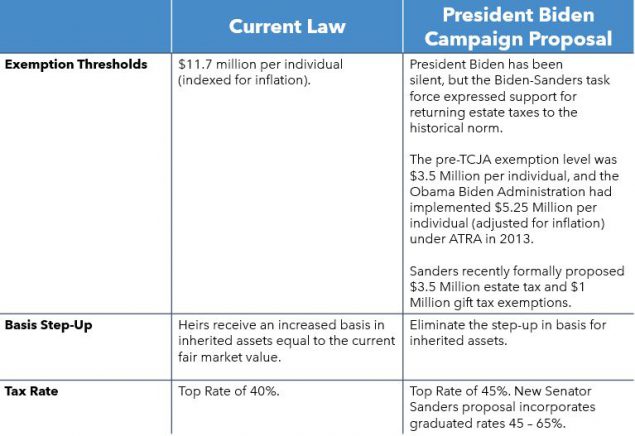

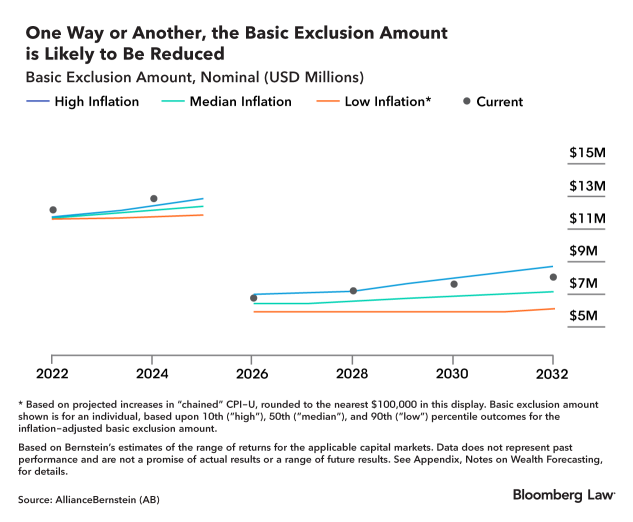

. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017. 97-0732 any and all. Instead the exemption would expire at the end of 2021 and beginning in 2022 the Federal Estate Tax will be reduced to 5 million.

Should this bill pass into law it means that. Estate Tax Change Proposals 2021. The proposal seeks to accelerate that reduction.

On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as HR. While the more recent focus has been on changes to capital gains taxes and basis adjustments there have already been several proposals targeting the estate and gift. The 2021 exemption is 117M and half of that would be 585M.

The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will be. 5376 by Congressman John Yarmuth. Their victories in both Georgia runoffs give them nominal control over all three levers of.

CHANGE OF PAYMENT OF ILLINOIS ESTATE TAX TO THE ILLINOIS STATE TREASURER. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of. Democrats enter 2021 with an opportunity to make significant changes to tax policy.

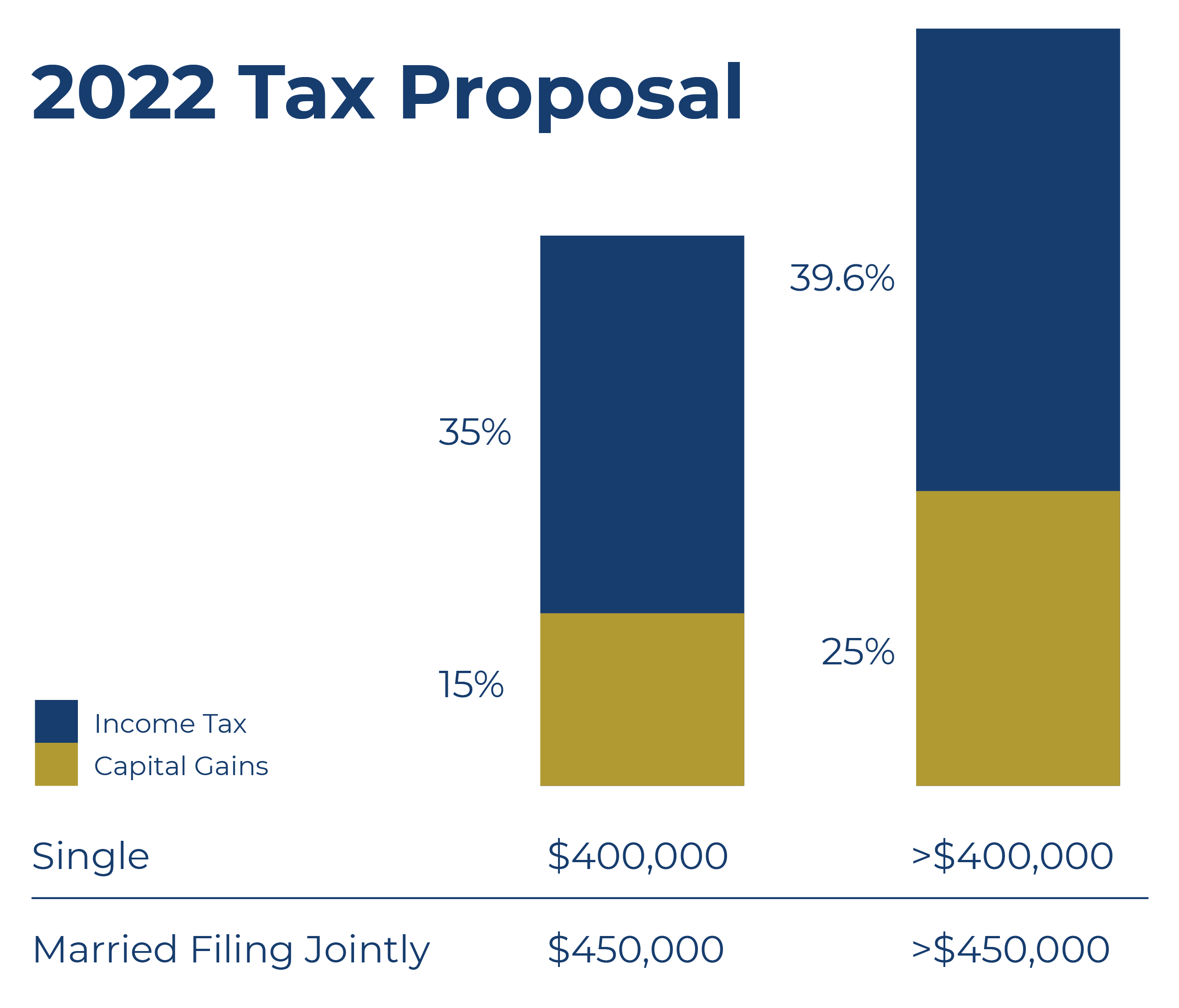

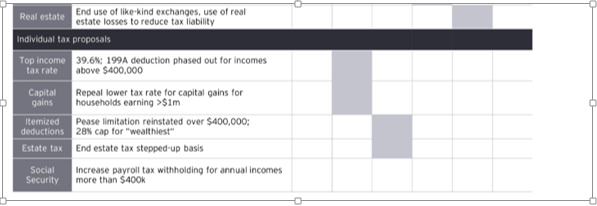

An investor who bought Best Buy BBY in. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. For this reason individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021.

In recent weeks this. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift. Chicago Mayor Lori Lightfoots proposed budget for the fiscal year starting January 1 2021 includes a property tax increase of 939 million for a total property tax levy of 16.

Administration proposals included a provision to tax capital gains at death. Thirteen states have notable tax changes taking effect on July 1 2021 which is the first day of fiscal year FY 2022 for every state except Alabama Michigan New York and. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025.

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Planning In A Biden Administration Denha Associates Pllc

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Election Special Bulletin 1 Tax Plan Proposal

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate Tax Current Law 2026 Biden Tax Proposal

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Big Proposed Federal Tax Changes W Brent Nelson Youtube

Charity Navigator Planning Now For The Estate Tax Overhaul

How The Tcja Tax Law Affects Your Personal Finances

Build Back Better Act And Estate Planning

Potential Biden Proposed Tax Changes Becoming Clearer Amg National Trust

Proposed Impact Of The American Families Plan Tax Proposal Fein Such Kahn Shepard

Gift And Estate Tax Changes Stark Stark Jdsupra

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine